richmond property tax payment

To mail your tax payment send it to the following address. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate established.

Online Payments Other Services Elections and Voting Weather and Traffic.

. Make sure that Richmond Hill has your current mailing address information. Payments can be made through the mail the tax commissioners website and at the Municipal Building. Other Services Adopt a pet.

To pay by phone please call 1-844-368-1560 -. All late payments accrue interest. Payments cannot be taken at the tax commissioners tag offices.

Mail payments early to avoid penalties If your property tax payment does not arrive at City Hall on or before. For property tax payments include the 9-digit Folio Number located the top of the Property Tax Notice. Please note that failure to receive a tax bill does not negate the requirement to pay the tax.

The City Assessor determines the FMV of over 70000 real property parcels each year. Below are links for online payments for Richmond County services. To avoid additional cost any payment is on time if postmarked on or before the due date.

Richmond County Treasurers Office. 295 with a minimum of 100. Electronic Check ACHEFT 095.

Online Property Tax Payment Fees. Free Case Review Begin Online. All City of Richmond delinquent taxes 2018 and prior must be.

Billing and payment options please contact the Richmond County Treasurers Office for information regarding your bill or payment options. RICHMOND CITY HALL 450 Civic Center Plaza Richmond CA 94804. REAL ESTATE TAXES Real Estate Taxes are assessed on all land buildings and any other improvements attached to the land and.

209 of total minimum fee of 100. Property Taxes Due 2021 property tax bills were due as of. By Richmond City Council.

Ad Pay Your Taxes Bill Online with doxo. To pay your 2019 or newer property taxes online visit the Ray County Collectors website. Pay your taxes online by visiting our Tax Payment Site at www.

Personal property tax bills have been mailed are available online and currently are due June 5 2022. As June 5 falls on a Sunday all payments. For more information call 706-821-2391.

Register to Receive Certified Tax Statements by email. Based On Circumstances You May Already Qualify For Tax Relief. Payments should be mailed to.

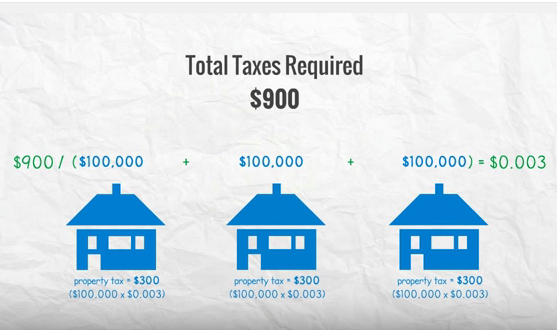

Richmond Hill now accepts credit card payments for property taxes. Property value 100000. Broad Street Richmond VA 23219.

To contact City of Richmond Customer Service. Taxpayers can either pay online by visiting RVAgov or mail their payments. We offer a number of payment options including pre-authorized payment.

Richmond County Tax Collector. Property Tax Vehicle Real Estate Tax. Find details about tax types assistance starting your own business and more on our TaxFeeLicense Descriptions Page.

City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector. Real Estate Taxes. Ad See If You Qualify For IRS Fresh Start Program.

Real Estate and Personal Property Taxes Online Payment. Submit Tax Payments PO. Monday - Friday 8am - 5pm.

The Tax Commissioner is an elected Constitutional Officer responsible for every phase of collecting property taxes from processing property Homestead Exemption applications through preparation of the digest billing accounting and disbursements. Cheque payments are payable to. Inquiresearch property tax information.

Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph. With this option the company that processes the payment will. Business License - City of Richmond Instructions for Business License Online Payments httpsetrakitcirichmondcaus Parking Tickets - T2 Systems https.

PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL. The Tax Commissioner is an elected Constitutional Officer responsible for every phase of collecting property taxes from processing property Homestead. Make checks or money orders payable to Richmond County.

Council Suggests Tax Deferrals As Thousands Lose Homeowner Grant Richmond News

Richmond Property Tax 2022 Calculator Rates Wowa Ca

Transfer Tax Increase To Become Contentious Issue For Richmond Voters Richmond Confidential

Column The Ugly Truth About Local Property Tax Increases The Augusta Press

City Of Richmond Personal Property Tax Fill Online Printable Fillable Blank Pdffiller

Richmond Hill Has Moved The May 1 City Of Richmond Hill Facebook

Property Tax Roundup Ringwood Richmond Bull Valley Barrington Hills Have Highest Tax Bills In Mchenry County Mchenry Times

Community Workshop Potential Vacant Property Tax Workshop 3 Richmond Ca Youtube

Assessor Of Real Estate Richmond

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate

Richmond And Henrico A Tale Of Two Revenue Streams Taber Andrew Bain

Property Tax Archives Richmond Confidential

Richmond Heights School District To Consider Replacing Property Tax Funding With An Income Tax Specifically Earmarked For Schools Cleveland Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5

Property Rehab Program Being Examined In Richmond Va Builder Magazine